M&A Buy Side Process

M&A Buy Side Process

Mavengigs

Mavengigs is a global consulting firm providing consulting services for Mergers & Integrations (M&A) and Transformations. Through our network of independent resources and partners, we serve clients in USA and Europe. Mavengigs is a division of Panvisage Inc. (a holding company with interests in consulting, education, real estate and investments).

This content is a synopsis from multiple sources for easy reference for educational purposes only. We encourage everyone to become familiar with this content, and then reach out to us for project opportunities.

M&A Buy Side Process

Buy side M&A is a process in which a company seeks to acquire a business or asset. Buyer is typically looking to expand their market presence, diversify their portfolio, or gain a competitive advantage.

Buyer is in a stronger negotiating position than the Seller, as Buyer can chose from a wider pool of potential targets. Buy Side M&A is simpler than Sell Side M&A as Buyer is only dealing with one potential seller. However, there is risk of overpaying for a business or asset, and risk inheriting hidden liabilities.

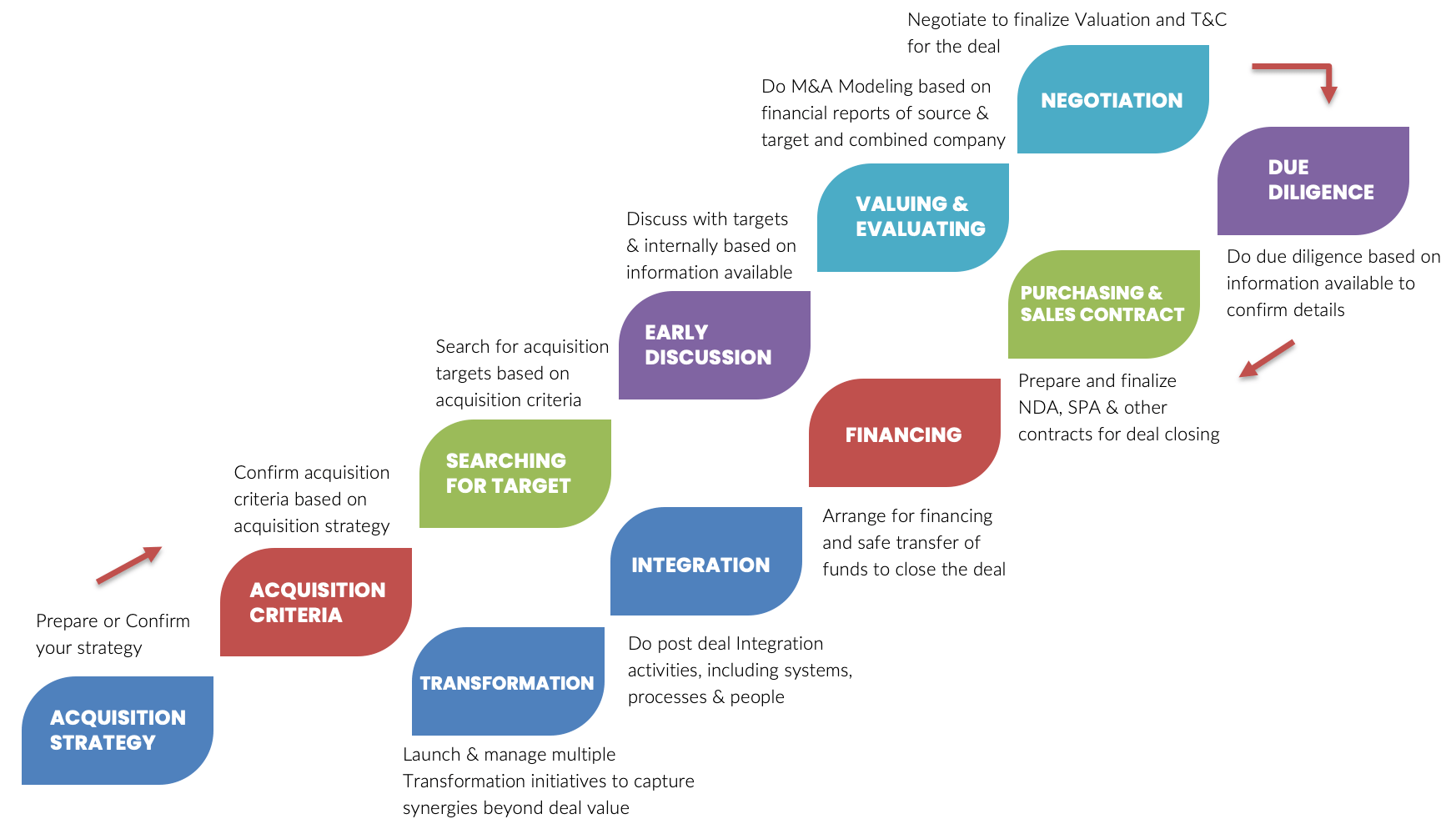

M&A Buy-Side Process typically involves ten steps, including Acquisition Strategy, Acquisition Criteria, Searching for Target, Acquisition Planning, Valuation and Selection, Negotiation, Due Diligence, Purchase and Sales Contract, Financing and Implementation. Overall process could take 6 months to several years to complete, depending on size of transaction.

Acquisition Strategy

Developing a good acquisition strategy depends on the acquirer having a clear idea of what they expect to gain from the transaction, i.e. what is their business purpose for acquiring the company (e.g. expand product line, gain access to new market, finding growth opportunities, broadening their range of products, etc.).

The leadership team and external advisors work together to craft a comprehensive strategy for mergers and acquisitions. This strategy includes setting specific goals for the potential deal and pinpointing companies that could help achieve those goals. At this stage, it is crucial to consider the acquiring company’s current financial situation, market conditions, and future forecasts. These factors will impact the viability of the acquisition and the potential benefits that can be realized from it.

Acquisition Criteria

Determine the key criteria for identifying potential target companies (e.g. profit margins, geographic locations, or customer base).

Buyer sets out a list of criteria to guide them in finding suitable targets that align with their objectives, including several key areas:

-

- Industry: Determine if the potential target operates in the same or a closely related industry; confirm any overlaps.

- Geography: Assess whether acquiring the target can provide access to new geographical areas or increase their existing market share.

- Revenue: Understand the financial size of the combined company and figure out how much money the united company would generate.

- Market: Analyze the target’s market to determine if acquiring the target would contribute to buyer’s growth or expansion plans.

- Intellectual Property: Review if target company possesses any valuable assets, such as patents or trademarks, that the buyer can acquire.

Searching for Target

To identify and assess potential targets, the acquirer employs the criteria they’ve established earlier. They rely on publicly available data from tools like Pitchbook, Capital IQ, Bloomberg, and similar resources. In some cases, they might enlist the help of consultants to assist in this process. It’s all part of the strategic journey toward a potential merger or acquisition.

Based on the results of the initial search, acquirer prepares a shortlist of potential candidates for a high level review against the evaluation criteria. This preliminary evaluation is high level, bit should include an analysis of target’s financial position, industry position, and potential for synergies.

Acquisition Planning

The acquirer makes contact with one or more companies that meet its search criteria and appear to offer good value, with the purpose of getting more information and to see how amenable they may be to a merger or acquisition.

Acquirer sends them a Letter of Intent (LOI). This letter expresses their interest in joining forces through a merger or acquisition and provides a basic outline of what the deal might entail. The primary aim of this step is to let the potential target know about the interest in merging or acquiring them. It serves as an initial inquiry to gauge their interest in the deal. Additionally, the acquirer seeks more information from the target, which will be crucial in the valuation process if the deal progresses. They may sign a Non-Disclosure agreement (NDA) initially, and then a more detailed Confidentiality Agreement memorandum (CAM) to get detailed financial and operational data on the target’s business. This agreement allows them access to comprehensive financial and operational data about the target company’s business, helping the acquirer make informed decisions about whether to proceed with the potential deal.

Target Valuation

If the initial contact and conversations go well, the acquirer asks the target company to provide substantial information (financial and operational) that will enable the acquirer to further evaluate the target, both as a business on its own and as a suitable acquisition target.

Buy side representatives engage in a comprehensive valuation of the target using various financial models to determine the target’s intrinsic value as a stand-alone entity and its compatibility as a merger or acquisition candidate. Factors like cultural alignment and external conditions are also considered. Various valuation models are employed for this evaluation:

- Market Value Valuation: This method gauges the target’s worth by comparing it to recently sold similar companies.

- ROI-Based Valuation: The target’s value is assessed based on the investor’s ability to recoup their initial investment by understanding the potential investment returns of a particular deal.

- Multiple Earning Valuation: This method presupposes expressing the value of the target using a multiple applied to the company’s earnings. For instance, a company with annual earnings of $1 million with a multiplier of x6 will be valued at $6 million. The multiplier is dependent on many factors, such as predictability or recurring revenue.

- Discounted Cash Flow (DCF): Widely used, this method evaluates the target based on projected cash flows adjusted to their current value, offering a robust valuation framework.

Negotiation

After producing several valuation models of the target company, the acquirer should haves sufficient information to enable it to construct a reasonable offer. Once the initial offer has been presented, the two companies can negotiate terms in more detail. The carefully crafted offer, based on valuation results, serves as a foundation for discussions between the two companies. During negotiation, bot the acquirer and target companies collaboratively shape the deal’s terms and conditions, to reach a mutually beneficial agreement.

Due Diligence

Due diligence is an exhaustive process that begins when the offer has been accepted; due diligence aims to confirm or correct the acquirer’s assessment of the value of the target company by conducting a detailed examination and analysis of every aspect of the target company’s operations – its financial metrics, assets and liabilities, customers, human resources, etc.

Goal is to double-check and fix any mistakes in the Buyer’s estimate of the Target company’s value, and involves looking into everything about the Target including customers, revenue, expenses, assets, liabilities, debt, employees, legal and taxes; to confirm that they are getting what they think they are.

Sale and Purchase Agreement (SPA)

Assuming due diligence is completed with no major problems or concerns arising, the next step forward is executing a final contract for sale – the Sale and Purchase Agreement (SPA); the parties make a final decision on the type of purchase agreement, whether it is to be an asset purchase (some or all assets) or share purchase (like owning the shares).

The final contract for sale is called the Definitive Purchase Agreement (DPA) and has all the important details of the deal; this is signed as a final agreement.

Financing

The acquirer will, of course, have explored financing options for the deal earlier, but the details of financing typically come together after the purchase and sale agreement has been signed. The financing strategy is implemented to get the money to make the purchase happen. They will sign a Term Sheet with details related to financing.

Implementation

The acquisition deal closes, and management teams of the target and acquirer work together on the process of merging the two firms. This complex process is covered in detail under Integration.

Structuring the M&A Deal

M&A deal has to be structured properly considering many factors:

(a) Structuring Environment, which includes factors like business plan, market conditions, preferred forms of financing, and transaction character

(b) Transaction Environment, which includes factors like antitrust laws, securities regulations, corporate law, competing bidders, taxes, accounting issues, contracts, and market conditions.

M&A Buy Side Process Flow

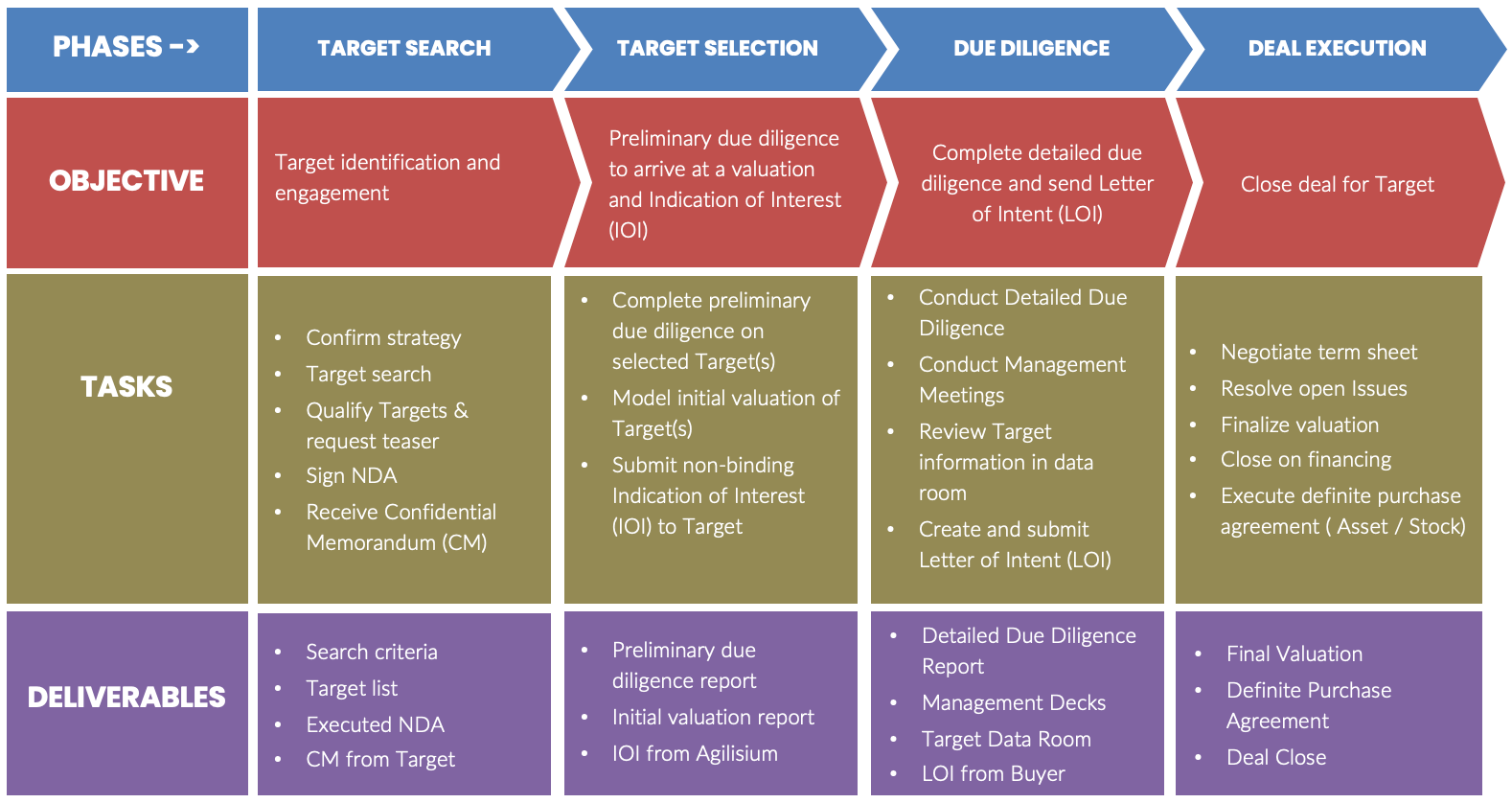

M&A Buy Side Phases and Deliverables

Please contact us today!

Mavengigs

16192 Coastal Highway, Lewes, DE 19958

Contact Us

Ph: (310) 694-4750 sales@mavengigs.com