Integration

Post Merger Integration (PMI)

Mavengigs

Mavengigs is a global consulting firm providing consulting services for Mergers & Integrations (M&A) and Transformations. Through our network of independent resources and partners, we serve clients in USA and Europe. Mavengigs is a division of Panvisage Inc. (a holding company with interests in consulting, education, real estate and investments).

This content is a synopsis from multiple sources for easy reference for educational purposes only. We encourage everyone to become familiar with this content, and then reach out to us for project opportunities.

Closing and Day One

Day One is when the deal is announced and change of ownership takes place. This kicks off Post Merger Integration (PMI). The First 100 day includes activities like integration planning, key decisions, set priorities, finalize organization structure, and align on cultural issues. Subsequently synergies begin to be captured and cost savings begin as changes are implemented. Additional synergy capture and value creation continue through first year and beyond. Subsequently transformation projects are kicked off for additional value creation beyond the initial deal thesis.

Integration Process

Integration may require changes in business operations, people, processes, culture and structure. Two companies need to be combined while ensuring their businesses continue without disruption. Integration should be done at speed as investors expect to see synergies captured and cost savings realized in 12-124 months of deal close. The longer it takes, the more disruption it will cause, as key staff may leave.

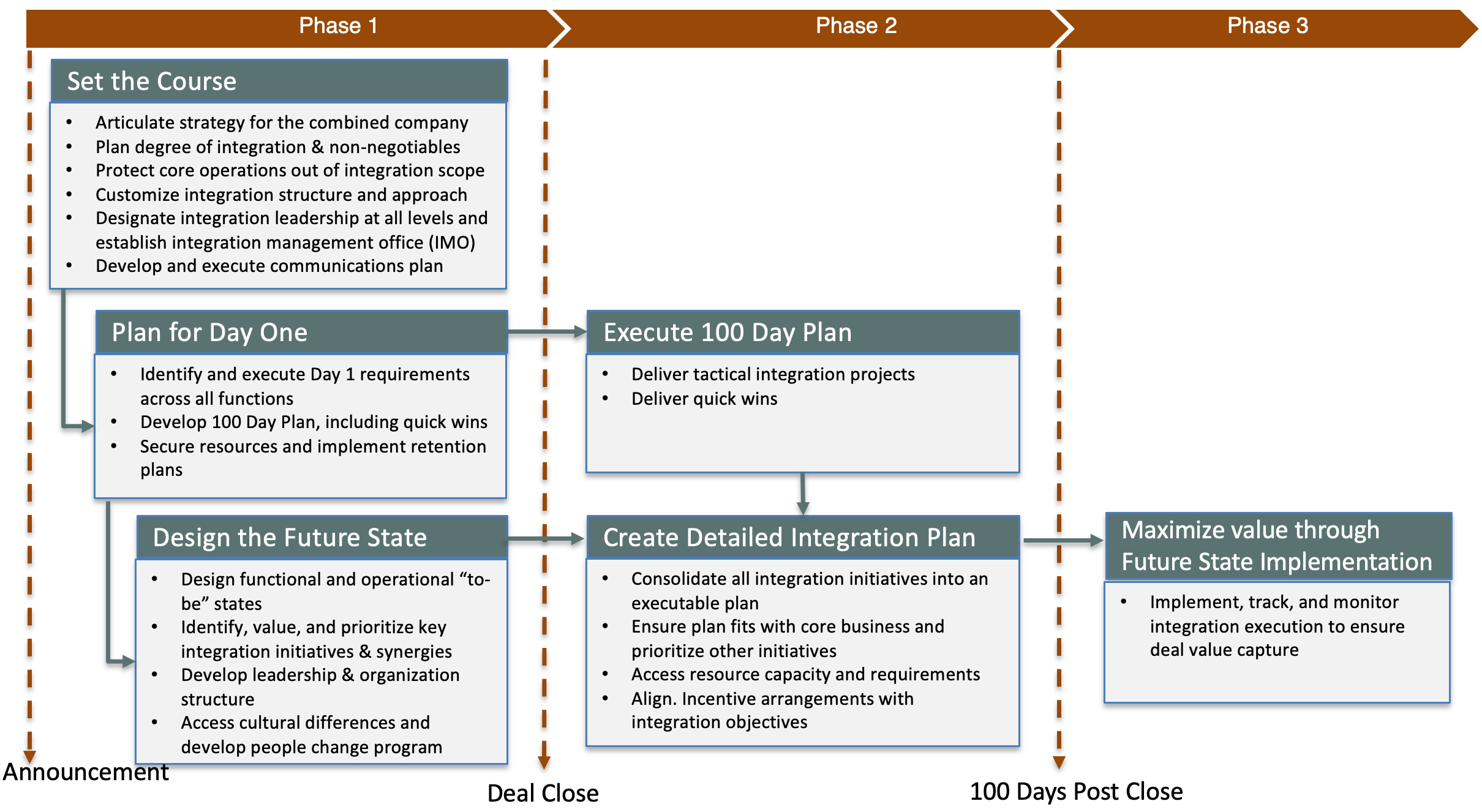

Integration is done in phases, and follows a sequence of coordinated steps to focus resources and capital on the right resources at the right times. We need to set the course, execute day one and maximize future state.

We need to emphasize importance of getting the fundamentals of integration in place as quickly as possible to minimize disruptions and achieve synergies. Rapidly launch integration efforts to to set the course, then plan for and execute day one; and then design and maximize future state operations.

Integration Governance

Doing deals is risky, and many acquisitions don’t achieve the expectations set, as the deal strategy does not translate into integration success. Converting integration strategy into detailed actions that align people, process, and systems with integration objectives requires an effective governance structure called the Integration Management Office (IMO). IMO makes sure that integration stays on course, and sustains focus on the right activities.

Integration Management Office (IMO)

IMO is the nerve center for Integration as it puts in the management structure, people and processes for integration to capture deal value using disciplined cross functional approach. It defines integration basics, including degree of integration and non-negotiables across functions and geographies; rolls out methodologies, tools, templates, status reporting, dependencies, issue management, issue escalation, decision making, centralized value driver process and tracking, managing resource constraints and launching key communications. IMO is different from project management; it’s more more pervasive, lasts longer, has greater need for flexibility to adjust over different integration phases, and requires a higher level of executive oversight.

Degree of Integration

Every organization is different; it’s critical for IMO to define the degree of integration across functions and geographies, and communicate the decision. This will serve as initial target operating model and guiding principles for each business unit or function to develop and execute detailed plans. Degree of integration depends on type of transaction, similarity or dissimilarity of the businesses, synergy targets, potential for disruption to core operations, and control decisions; Examples: (a) For industry consolidation, the degree of integration is high with greater synergies expected; (b) For stand-alone type acquisition (when expanding to a new product or market), degree of integration is lower, with lower synergies.

M&A for Growth

M&A can be a powerful vehicle of growth, offering companies a stronger cash position, higher market share, broader customer base, and access to new technologies, products, and distribution channels. It is an important strategic option that companies can leverage to make necessary leaps in a competitive marketplace; Failing to embrace a smart M&A strategy can result in an opportunity cost that hinders a company’s ability to thrive.

Integration Risks

Despite their best intentions, many companies fall short in their efforts to integrate people, process, and technology, resulting in unsuccessful integration efforts that take too long and squander valuable time, personnel, money, and other resources. This leads to business disruptions and loss of opportunities to create value. The negative impacts of such unsuccessful integrations include the departure of key executives and employees due to frustration, a drop in shareholder value, damage to the company’s reputation and ability to raise capital, impaired relationships with vendors and customers, unplanned expenses, missed deadlines, and more.

Integration Playbook

Successful M&A integration is where M&A goals are met, synergies are captured, and value gets delivered. To make this outcome more likely to deliver good results repeatedly, it’s crucial to formalize a game plan for each deal. This game plan, known as the M&A Playbook, serves as both a business plan and a how-to field guide. It provides step-by-step guidance for tactical integration, ensuring that everyone is on the same page and moving forward effectively to deliver deal value.

Integration Playbook (Continued)

The Playbook sets the standard for speed, consistency, accountability, and repeatability, serving as a shared reference for structuring, planning, cooperation, and discipline at each stage. It encompasses objective evaluation, clear communication, accelerated integration, and a quick return to business as usual. Furthermore, the Playbook offers a rigorous, systematic framework for integrating target companies, improving speed, consistency, and control. It establishes a team-based governance structure to link integration strategy to task-level actions. Importantly, the Playbook should be tailored to reflect your company’s strategy and goals, appetite for risk, operating structure, corporate culture, IT capabilities, communication capabilities, and relationships with stakeholders.

Integration Playbook Components

- Methodology: Consider company’s integration strategy and approach, governance structure, tools, communication methods to support deal.

- Leadership: Define key integration leaders, extended team members, integration roles and responsibilities, team skills and training.

- Process: Integration planning steps during evaluation, due diligence, closing, post-closing phases; tools to be used, any tools to help integration teams collaborate efficiently, quickly and consistently.

- Standardization: Define integration team’s interaction with executives, business leaders, other stakeholders; guiding principles to be captured & shared, standards to be adopted for analyzing data & making decision.

- Repository: Centralized repository of information for all M&A team members, includes standard format for capturing and sharing information.

- Communication: How to address specific concerns of each group of stakeholders, including employees, investors, customers, vendors; main consistent message and tone; process for ongoing shareholder dialog; how to use communication to retain employee and customers during period of disruption; clearly articulate it’s deal thesis and reasoning behind decision.

- Knowledge Management: Learnings from previous integrations; how to retain knowledge accumulated during upcoming integration.

- Organization Structure: Consider how to migrate different management structures into a single management team; impact of these changes.

- Workforce: Determine the impact of employee selection and retention; how to combine two workforces that come from different corporate cultures; how to communicate transparently with all workers.

- Business Process: Confirm critical business processes at the company as well as the target company; confirm processes for the combined company.

- Systems: Identify what systems will be redundant when two companies are combined; how to decide which company systems will be adopted for the future company.

- Data Management: How do we consistently migrate systems and data; understand requirements for key systems throughout the integration, and for the go-forward company.

- Policies: Identify key governance and operating policies required for the integration, and for the go-forward company.

- Contract Management: Understand contractual obligations for both companies; how to leverage favorable terms.

- Legal Entity Structure: Do we need to change the legal structure of the go-forward company; impacts to accounting, taxation, operations, sales, manufacturing, and support functions.

- Customers and Vendors: how to align sales force and customer assurance programs; how and what message to communicate with customers and vendors.

Key Tenants of a Successful Integration

Capturing sustained economic value in M&A is a challenge. Regardless of deal size, complexity, or geographic reach, some fundamental tenets are key to success for realizing deal objectives:

- Accelerate the transition to obtain bottom-line results quickly and maximize shareholder value. There is no value in delay. Prolonged transitions slow growth, reduce profits, destroy morale and productivity, and lead to missed opportunities and loss of market share.

- Clear integration strategy to be defined and communicated. Integration is highly tactical effort, and must be implemented to capture and protect the value of the deal; best to have well defined integration strategy.

- Focus resources on priorities with potential for value capture. Shareholder value must drive allocation of resources in priority of potential financial impact, probability of success, and timeline requirements.

- Prepare for Day One critical tasks to avoid surprises. Identify critical day one tasks early before longer-term detailed planning starts; promptly identify longer lead time items to avoid closing day surprises.

- Communicate early and often with all stakeholders. Communicate with stakeholders including customers, employees, investors, vendors, and public; including reasons, timing, key actions, unknowns, etc.

- Establish leadership and role clarity at all levels. Requires significant high-quality committed resources; critical to assign accountability, functional authority and role clarity at each level.

- Manage as a Business: Run integration as a well-defined process to focus resources and capital on the right activities at the right time.

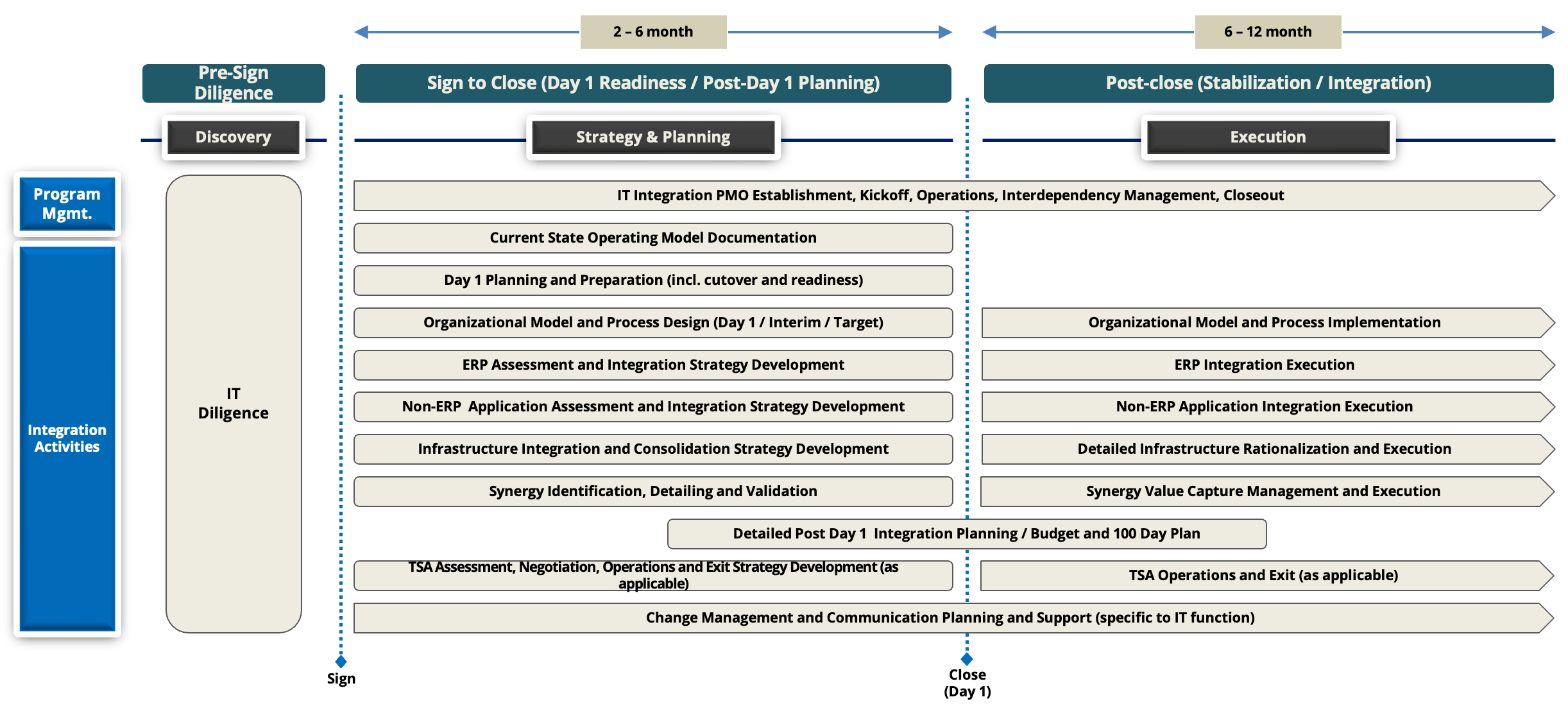

Integration Roadmap

Integration Process

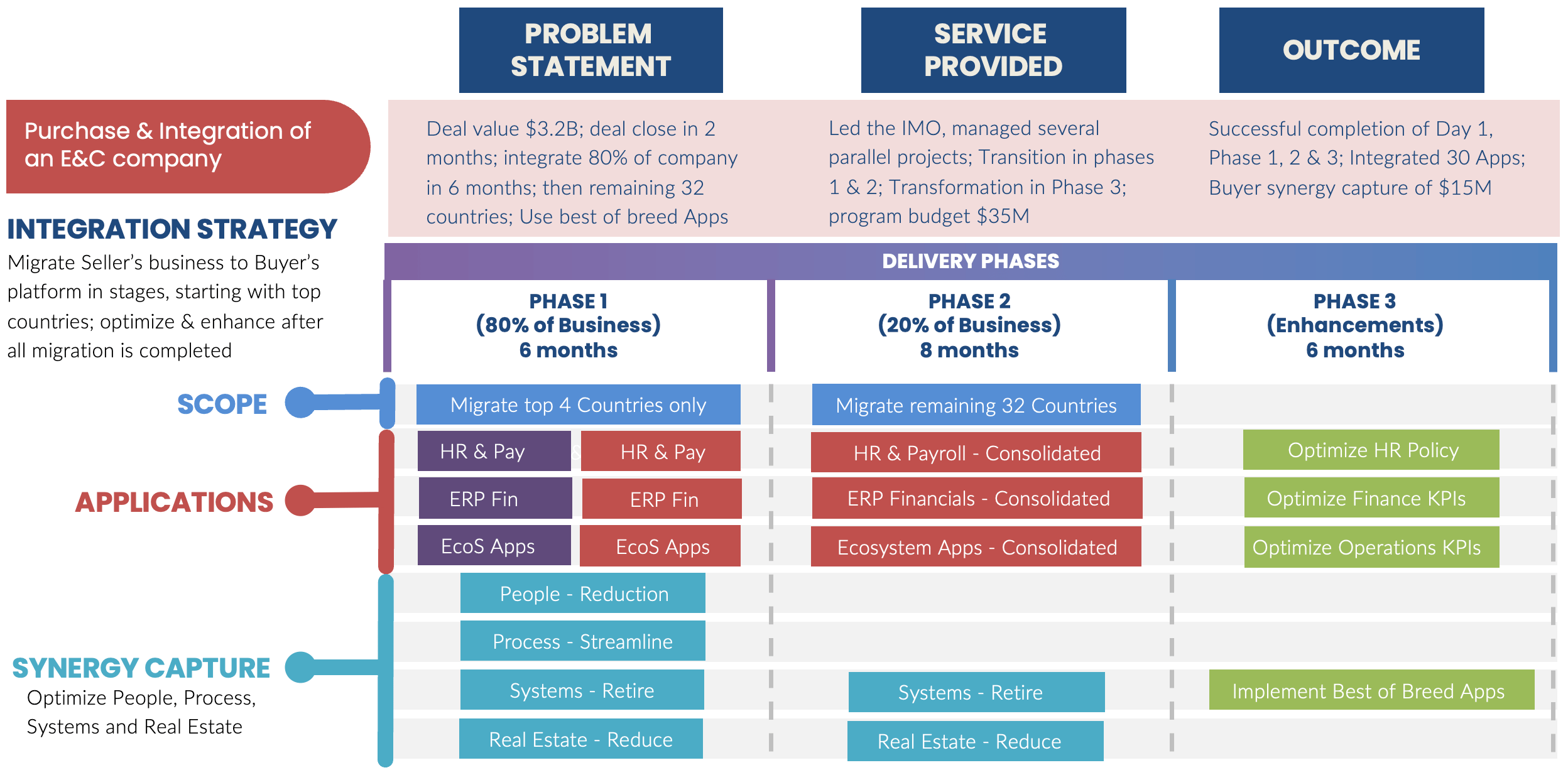

Integration Business Case

Please contact us today!

Mavengigs

16192 Coastal Highway, Lewes, DE 19958

Contact Us

Ph: (310) 694-4750 sales@mavengigs.com

Los Angeles

San Francisco

Chicago

New Delhi