M&A Introduction

Mergers & Acquisitions (M&A) Introduction

Mavengigs

Mavengigs is a global consulting firm providing consulting services for Mergers & Integrations (M&A) and Transformations. Through our network of independent resources and partners, we serve clients in USA and Europe. Mavengigs is a division of Panvisage Inc. (a holding company with interests in consulting, education, real estate and investments).

This content is a synopsis from multiple sources for easy reference for educational purposes only. We encourage everyone to become familiar with this content, and then reach out to us for project opportunities.

Mergers and Acquisitions (M&A)

M&A stands for Merger and Acquisition, and it broadly refers to a company buying or selling another company. M&A Strategy is part of a company’s growth strategy (buy versus build).

Mergers and Acquisitions (M&A) refers to the management, financing and strategy of buying, selling, combining or splitting companies. Merger is a combination of two companies (Integration). Divestiture (or De-Merger) is splitting a company into multiple parts.

Buyers & Sellers may buy or sell for different reasons, and an M&A transaction takes place when the interests of the buyer and seller align.

Why do Sellers sell?

Sellers may decide to sell for various reasons. A family business owner may decide to leave the business. A disruptive company may decide to sell to a competitor or a partner. Venture Capital (VC) or Angel Investor backed companies may try to exit with an appropriate Return on Investment (ROI). Founders may wish to pursue other ventures. A target company may evaluate unsolicited offers received. The Board of Directors of a company have the responsibility to act in the best interests of the company and its shareholders and may decide to sell.

Why do Buyers buy?

Buyers may decide to buy for various reasons. A company may decide to expand into new markets, new geographies, new products, a new customer base, or just expand market share. They may decide to acquire a disruptive technology (speed up growth with ‘Buy versus Build’). Buying another company can create synergies of scale and maximize efficiencies, resulting in higher returns for the shareholders of the combined company.

M&A for Growth

Many organizations continue to increase their earnings through better managing their costs and balance sheets. But due to global competition and disruptions due to transformations, competition continues to intensify, and investors and boards are demanding more top-line growth as a way to further increase shareholder value. Many are pursuing this growth in revenues and earnings through mergers or acquisitions, which is a challenging endeavor for the companies involved.

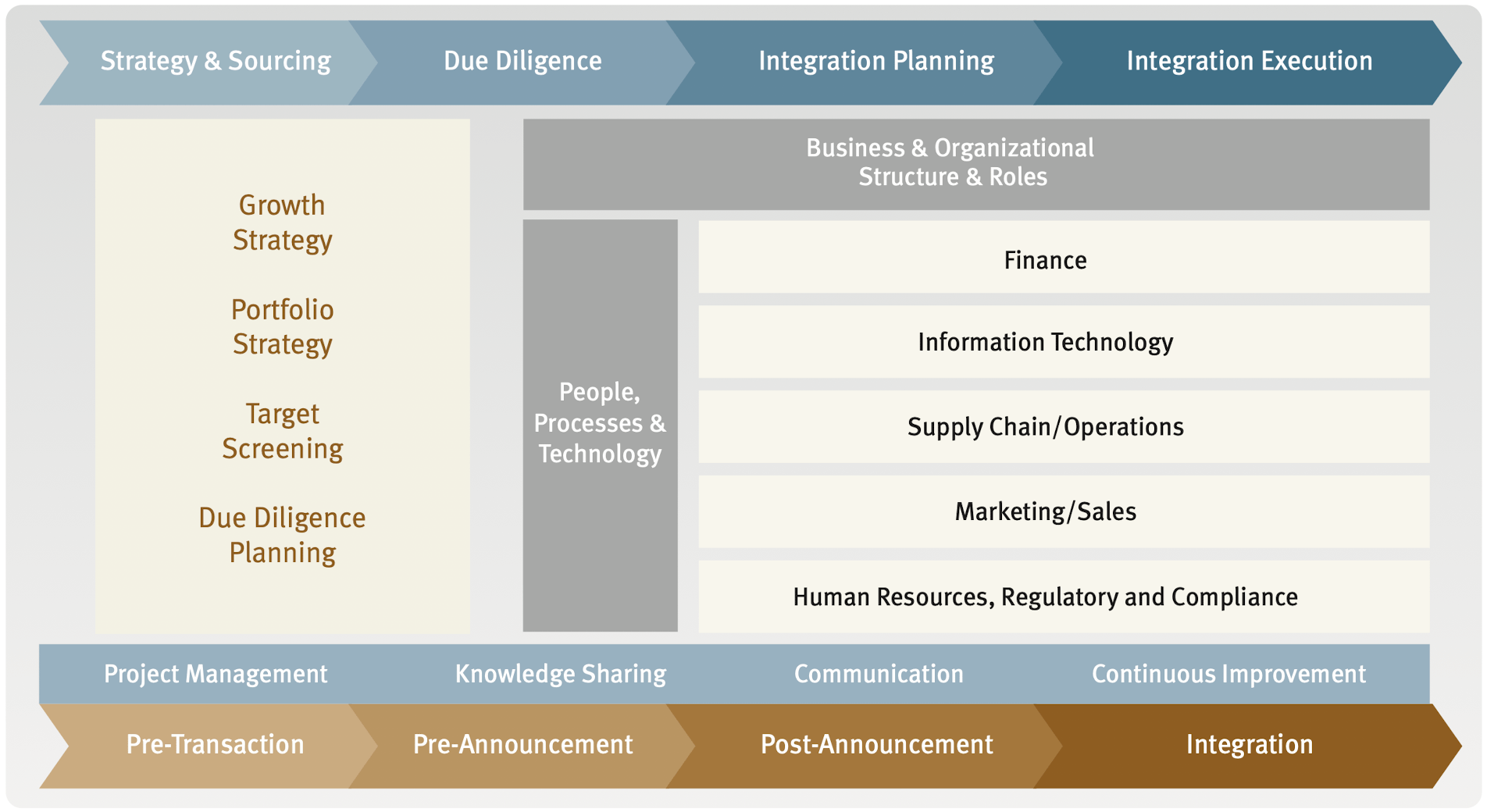

Companies considering such endeavors will need to (1) carefully articulate a growth strategy that aligns with their overall corporate strategy (with proper board involvement); (2) identify the right markets and targets; (3) define and execute a thorough but fast-paced diligence process; (4) prepare a detailed integration plan by phases; and (5) follow up with a well-resourced and communicated integration execution across many complex functions, dispersed technologies and geographies to capture the targeted deal values.

Merging two or more organizations is a complex transaction filled with risk. The best deals follow a structured and disciplined approach, with clear strategic objectives, comprehensive due diligence, detailed integration plans, and a focus on creating and capturing value.

A failed M&A attempt results in significant impact to shareholder value. Many deals do not achieve their intended results. There is a need for guidance and lessons learned to increase the odds of achieving targeted values of proposed transactions in a timely manner.

M&A requires global expertise with a cross-disciplined team that brings broad perspectives and deep expertise capable of leading the transaction PMO (IMO, SMO) and diving deep into a variety of business and regulatory issues. Teams need to be structured with a flexible delivery model that adapts to the constantly changing fixed and variable resourcing needs of each transaction. Need to use project management tools and techniques to manage key risks and fully capture the targeted results of the deal.

Different Deal Structures:

M&A Deals may have three types of deal structures, including asset purchase, stock purchase, or merger. The type of deal structure used depends on the size of the deal, the laws of the state of incorporation, and federal tax laws. Mergers are more common at the higher end of the M&A market, asset purchases are more common at the lower end of the market, and stock purchases are more common in the middle market.

(a) Asset Purchase:

Asset Purchase refers to a Buyer purchasing specific assets of a Seller, as listed in the transaction document. It could be all, or part of the assets of the business. Buyers like this deal structure as they can avoid buying unwanted assets, and don’t assume any liabilities of the Seller, thus reducing transaction risks. Buyers get better tax treatment, as they step-up the cost basis of the acquired assets; and increase losses when they later sell or dispose those assets. This requires third party consent when transferring contracts from Seller to Buyer. Sellers don’t like this, as they are left with potential liabilities. Sellers also get less favorable tax treatment, including potential double taxation (for a C Corporation) on income from sale proceeds.

(b) Stock Purchase:

Stock Purchase refers to a Buyer purchasing stock or equity interest of the target company directly from Seller’s shareholders. Company remains a ‘going concern’, including all its business, assets and liabilities. Sellers prefer this, but Buyers may be exposed to unknown liabilities, and have less preferential tax treatment (as no ‘step-up cost basis’ is available). In certain cases, Buyers can make an election to treat the stock purchase as an asset purchase, thus preserving the preferred tax treatment.

(c) Merger:

Merger is a type of acquisition when two separate legal entities come together and only one legal entity survives by action of law. All assets and liabilities of each are owned by the surviving entity. Surviving entity could be a Buyer (Forward Merger) or a subsidiary of a Buyer (Forward Triangulation Merger) or a Seller (Reverse Merger) or a subsidiary of a Seller (Reverse Triangulation Merger). It’s generally better to keep the surviving company separate by using a wholly owned subsidiary of the buyer or seller to limit liability. Mergers require approval from the Seller’s Board of Directors and a majority of the Seller’s Shareholders. Merger is taxed based on its deal structure; forward and forward triangular mergers are taxed as asset purchases, while reverse triangular mergers are taxed as stock purchases.

Who are the M&A Players?

There are several M&A Players in the market, with different roles in the M&A process. Business Brokers (for smaller deals) or Investment Bankers (for larger deals) do similar tasks, including preparing a company for sale (they prepare a Teaser and a Book for the company), and help find Buyers (by using an auction process, or marketing to a curated list of Buyers). Business or Corporate Lawyers help with preparing documents like the Non-Disclosure Agreements (NDA), Sale and Purchase Agreement (SPA), various Contracts, and detailed Due Diligence. Accountants help with doing Financial Due Diligence. Tax Advisors help confirm tax strategies and impacts. M&A Consultants help with doing Integrations, including System Integration.

Strategic Buyers are those that are doing horizontal or vertical expansions; they identify and deliver operating synergies, including (a) hard synergies (cost synergies) and (b) soft synergies (revenue synergies). Financial Buyers: are private equity firms that leverage (using bank’s money) for maximum equity returns.

M&A Process: M&A process consists of 10 steps including (1) Acquisition Strategy, (2) Acquisition Criteria, (3) Searching for a Target, (4) Early Discussion, (5) Valuing & Evaluating, (6) Negotiation, (7) Due Diligence, (8) Purchase & Sales Contract, (9) Financing, (9) Integration).

M&A Playbooks

Every M&A Transaction is different and risky, and many M&A deals fail to achieve their target goals. Companies can follow standard practices defined in M&A Playbooks, which are tweaked to match specific situations. M&A Playbooks are available for Buy Side Process, Sell Side Process, Financial Modeling, Integration Playbook, Divestiture Playbook, etc. M&A activities can be streamlined for better coordination by use of standard platforms like Smartsheet, Midaxo, Devensoft, Office 365 (SharePoint, Teams), etc.

Please contact us today!

Mavengigs

16192 Coastal Highway, Lewes, DE 19958

Contact Us

Ph: (310) 694-4750, sales@mavengigs.com

Los Angeles

San Francisco

Chicago

New Delhi