Sell Side Process

Sell Side Process

Mavengigs

Mavengigs is a global consulting firm providing consulting services for Mergers & Integrations (M&A) and Transformations. Through our network of independent resources and partners, we serve clients in USA and Europe. Mavengigs is a division of Panvisage Inc. (a holding company with interests in consulting, education, real estate and investments).

This content is a synopsis from multiple sources for easy reference for educational purposes only. We encourage everyone to become familiar with this content, and then reach out to us for project opportunities.

Sell Side Process

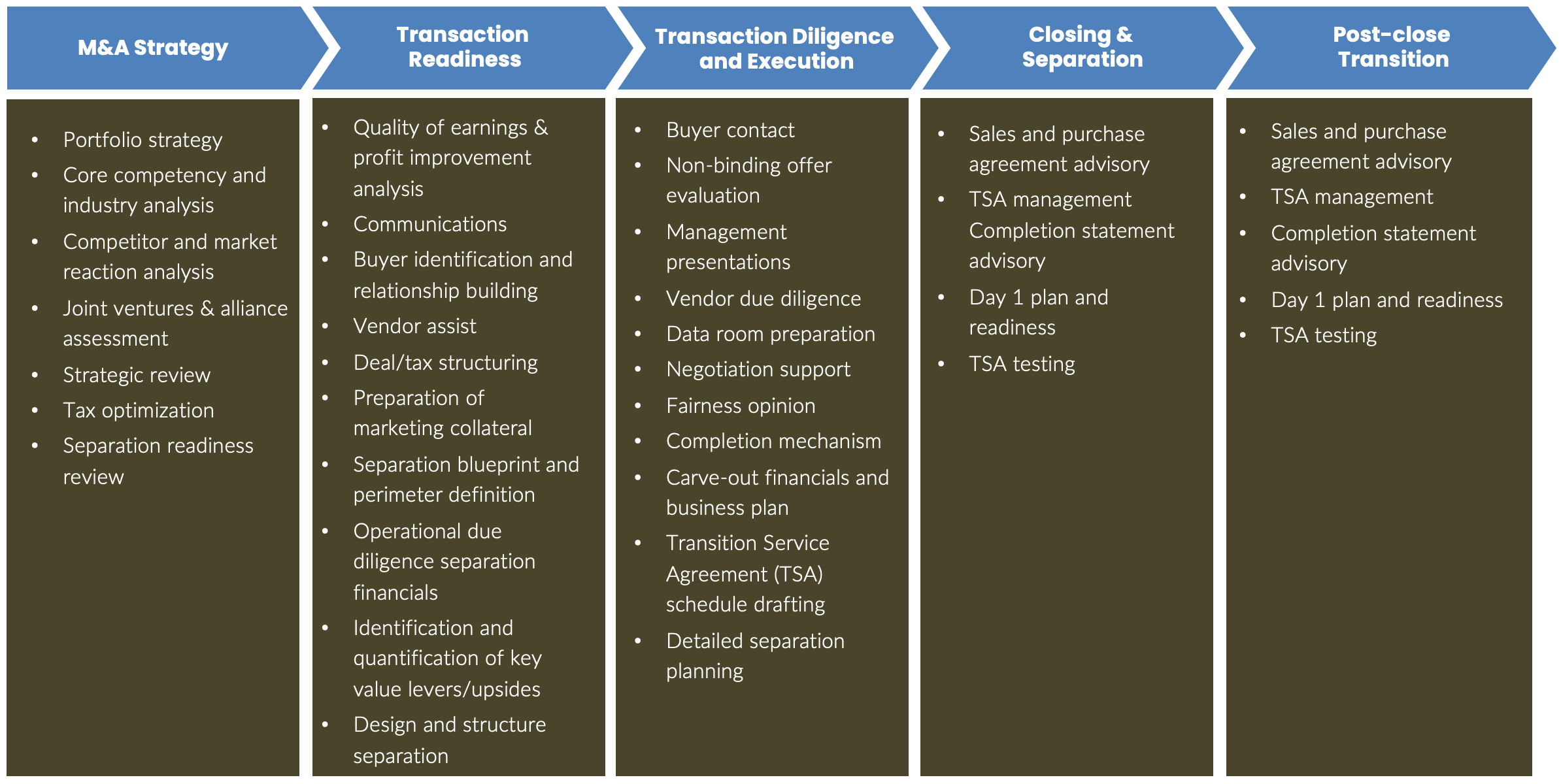

M&A Sell Side Process refers to selling an entire business, or part of a business. Post-deal divestiture includes separating systems, people, process, and contracts.

Choosing when to engage in a sell-side process is a crucial and complex decision requiring careful consideration. Well-performing businesses are in high demand. To navigate the intricate sell-side process and associated disruptions, Seller selects a business broker (for smaller deals) or investment banker (for larger deals), and they put together a Deal Team of experienced professionals to provide services like upfront comprehensive financial analysis and business valuation, overview of current market dynamics, precedent transaction comparable, and strategic alternatives. This provides the sellers with an expectation of how the market may perceive the business.

Phase 1: Market Preparation (Months 1-2)

Selling a business requires careful planning with a timeline. Advisor’s goal is to make the selling process quicker, get the best money for the business, and fit the seller’s goals.

Preliminary Due Diligence:

To customize the process for the Seller, the deal team and Seller hold a kickoff meeting. This all-day discussion helps advisors understand the business in detail. It’s a Q&A session where the team asks various questions about the company, such as its unique value, key customers, and vendors. The information gathered here is used to create marketing materials. The client’s data is organized into a secure virtual data room for buyers. Need to decide whether to use a targeted or broad marketing strategy.

Marketing Strategy:

Selling a business is like an auction, managed by an investment bank or business broker. Deal Team guides buyers through a structured process. Deal team identifies potential buyers interested in a certain industry. Auctions provide Seller with comfort that the broader market has been cleared and help establish a market value for the business. This strategy benefits both sellers and buyers, demanding significant time and resources. The deal team prepares marketing materials, addresses business weaknesses, readies management for Q&A sessions, and identifies potential buyers. Once the process begins, the team handles day-to-day execution, aiming to ease the burden on management so they can focus on business operations. Marketing strategies include:

- Targeted Marketing (Fireside Chats): This strategy focuses on a selected group of highly qualified and industry-savvy buyers to generate strong interest.

- Broad Marketing: This more common approach aims to attract a wide range of buyers with industry experience, promoting marketing competition and potentially achieving a higher enterprise valuation.

Both strategies offer sellers the ability to customize their process based on their objectives. For example, if maximizing value is priority number one, then a broader, more competitive strategy should be utilized. On the contrary, if the number one priority is a quick and efficient process, then a more targeted strategy can be utilized. Each strategy brings unique benefits to the Seller, and they select one that meets their objectives.

Develop Buyer Universe:

Developing a robust buyer universe is crucial in the sell-side process. The experienced deal team utilizes tools like S&P Cap IQ, Pitchbook, Bloomberg, and FactSet to create profiles of potential buyers. They consider factors such as investment criteria, industry expertise, fund size, portfolio track record, and market reputation when vetting and marketing the business to these selected buyers. Communication with prospective buyers occurs frequently, enhancing the chances of a successful transaction. A strong buyers list will contain three types of buyers:

- Strategic Buyers: Businesses that are operationally like the selling company and are looking to create a synergy within their existing businesses.

- Strategic Financial Buyers: Private equity firms that are currently invested in or have previously invested in businesses like the selling company.

- Financial Buyers: Private equity firms that are interested in investing in businesses of similar size and industry to the selling company.

Develop Marketing Materials:

Creating compelling marketing materials is essential in the sell-side process. These materials, including the teaser and confidential information memorandum (CIM), translate due diligence and data analysis into engaging narratives. The deal team works closely with management and advisors, like accountants and legal counsel, to accurately represent the business and highlight its investment potential, aiming to spark buyer interest and make a positive first impression.

Teaser:

This is the initial document prepared by Seller and shared with potential buyers in the sell-side process. It’s a brief, one-to-two-page confidential document that offers an overview of the business, its key selling points, and financial performance details. The teaser does not include the name of the business, and indicates that the business has enlisted an investment banking firm or business broker for the sale process.

Confidentiality Agreement (CA):

The confidentiality agreement (CA) is a legally binding document that safeguards both the Seller and potential buyers when sharing confidential information. Typically, the Sellers’ legal counsel prepares a standard CA. It’s shared with buyers along with the teaser, and it must be signed before they can access the Confidential Information Memorandum (CIM). Sometimes, there may be negotiations and revisions to the CA before final execution.

Confidential Information Memorandum (CIM):

Confidential Information Memorandum (CIM) is a used to convey important information about a business that’s for sale including its operations, financial statements, management team, and other data to a prospective buyer. CIM is prepared is by the Deal Team and shared with potential buyers; it’s used as a marketing document to make the company look good and sell for maximum value. CIM typically has the following sections: Executive Summary, Investment Thesis, Overview of the Market, Overview of the Target Company, Products and Services, Revenue Profile, Employee Profile, Customer Profile, Financials – Historical and Projections and Management Structure.

Phase 2: Marketing Process (Months 2-3)

Following the completion of all pre-marketing materials the business is ready to enter the marketplace. The deal team is responsible for bringing as many buyers through the sell-side process as possible while ensuring all parties move through at a similar pace. (Continued ->)

Phase 2: Marketing Process (Months 2-3)

(Continued ->) The sell-side process kicks off with the deal team sending a mass email containing the Confidential Agreement (CA), teaser, and a summary of the opportunity to prospective buyers. This marks the start of the process, known as being “in-market.” Interested buyers execute the CA to receive the CIM. For non-responsive buyers, senior team members follow up with phone calls. This phase takes several weeks as buyers internally review the materials. Interested parties may request a call with the deal team for clarification, and in competitive situations, high-level valuation guidance may be given to vet out inadequate buyers. Junior team members track all interactions, and have regular calls with Seller (shareholders) to provide updates on buyer status.

Prospective buyers have a few weeks to review the CIM and engage with the deal team before submitting their initial non-binding bid. During this period, the deal team, in collaboration with shareholders’ legal counsel, prepares a non-binding Indication of Interest (IOI) process letter. This document is shared with all potential buyers shortly after the CIM and outlines the information required for a thorough bid analysis. IOI process letters generally includes Due Date, Purchase Date, Assumptions, Financing, Strategic Synergies, Required Approval, Due Diligence Check List, Timeline and Post-Transaction Strategy.

Phase 3: Management Presentations (Months 3-4)

Phase 3 is crucial, where interested buyers conduct due diligence to prepare strong final bids for the LOI deadline. Depending on the type of buyer, the depth of due diligence varies. This phase can take weeks, involving management presentations, facility tours, and virtual data room management. The number of bids and buyers meeting shareholders depends on business attractiveness. Connecting buyers with management is vital. Behind the scenes, buyers continue due diligence and may consult their networks. Typically, 5-10 buyers meet shareholders, maintaining a competitive process and timeline.

Management presentations typically involve a day-long meeting between sellers and buyers. Key participants include the seller’s CEO, CFO, COO, and division heads. It often starts with an informal dinner the night before for personal introductions. During the presentation, a deck covers business history, value proposition, team, operations, financials, and growth strategy. The best meetings are interactive with Q&A, showing organization and professionalism.

Facility tours are crucial for due diligence. They occur at various stages to maintain confidentiality and employee continuity. A manager guides buyers through offices, warehouses, manufacturing, and distribution centers, encouraging questions and comparisons between the seller and buyer’s operations.

Virtual Data Room Access

Buyers gain access to a Virtual Data Room (VDR) during management presentations. A VDR is a secure online file system containing company data categorized similarly to the CIM outline. Categories include corporate documents, financials, operations, HR, insurance, real estate, and legal. VDR providers like Merrill Data Site, Intralinks, and Firmex offer customization options, control over downloading, redaction, and file access analysis. Costs vary based on deal size and data complexity. Serious buyers allocate resources for a thorough VDR review. They involve third-party experts like accountants and lawyers to assess synergies, opportunities, and risks. Q&A sessions occur as they analyze data. The deal team must be diligent, providing timely responses to questions while advancing others through management presentations, ensuring everyone has ample time for analysis in the final sell-side phase.

Letter of Intent (LOI) Process Letter

Distributing the Letter of Intent (LOI) marks the second round of bidding for remaining buyers. It’s a chance for them to make a strong impression. The LOI is structured like the Initial Offer (IOI) and outlines expectations for the final offer. It’s stricter and should be closely adhered to by buyers. LOIs submitted by the buyers are reviewed in grave detail in connection with legal and generally include- Due date, Consideration, Working capital, Sources and Uses of Capital, Due Diligence, Timing and Certainty to Close, Management, Compensation, Benefits Plan, Employment Arrangements, Management Incentive Programs.

Receive Final Letters of Intent (LOI)

Receiving LOIs is a significant milestone for sellers and the deal team. They indicate the business’s tangible value in the market. LOIs from buyers should be nearly final, pending confirmatory due diligence and securing financing. The deal team assists buyers in finalizing their bids and providing any necessary information to solidify the offer.

Phase 4: Due Diligence & Closing (Months 4-6)

Evaluate Final Bids and Select Final Buyer

After receiving LOIs from interested buyers, the deal team and seller’s legal counsel analyze them for purchase price, deal structure, and potential success. These are compared to the initial IOI bids for changes. The number of LOIs varies, and the deal team often advises negotiating with two or more serious buyers to increase competition. Negotiations involve senior team members from both sides and focus on seller objectives, including price, structure, and timeline. After negotiations, a final buyer is recommended. When the LOI is executed, exclusivity is granted for 30-90 days. During this time, the buyer finalizes due diligence, secures financing, and drafts the Definitive Purchase Agreement (DPA), concluding the sell-side process.

Definitive Purchase Agreement (DPA)

Buyer and Seller sign a Definitive Purchase Agreement (DPA), which is a legal document that records the terms and conditions between two companies that enter into an agreement. It is a mutually binding contract between the buyer and seller and includes terms and conditions such as asset purchased, purchase consideration, representations, and warranties, closing conditions, etc. DPA supersedes all prior agreements and understandings – both oral and written between the buyer and seller. DPA is used as a document to transfer the ownership of a company. The agreement also contains schedules or annexes describing the inventory list, key employees, tangible assets, net working capital determination, etc.

Closing Day

A simultaneous sign and close is the goal of any successful transaction and although it seems routine there are several moving parts that need to be checked and finalized. A seasoned M&A attorney is crucial for tasks like negotiating the purchase agreement (DPA). To achieve this, legal counsel must ensure:

- Final purchase agreement and related documents.

- Final employment and lease agreements if needed.

- The seller consents to all documents.

- Compilation of signature pages.

- Confirmation of wiring account details.

Once all consents and signatures are collected, both legal teams and involved parties schedule a call to release signature pages after due diligence confirmation. When signature pages are received, the buyer initiates wire transfers. Confirmation of funds hitting accounts marks the transaction’s close.

Sell Side Process Deliverables