Monty pandey

M&A and Transformation Executive

Monty Pandey

Monty has successfully executed M&A transactions totaling $20 Billion and spearheaded 50 transformations (including 30 enterprise wide deployments), resulting in over $100 million in business impact. His expertise includes managing large programs with multiple parallel projects to optimize organizational synergies and achieve desired outcomes.

Beyond his corporate endeavors, he is an investor and business owner in real estate, digital health, management consulting, consumer packaged goods (CPG) and films.

Monty’s significant experience

M&A Transactions

$ Billion M&A Deal Value

Business Transformations

$ Million Business Impact

Years of Consulting

president, Mavengigs

Mavengigs is a global consulting firm for Mergers & Integrations (M&A) and Transformations. Through our network of independent resources and partners, we serve clients in USA and Europe.

We bring on the right experts to deliver exceptional speed to value for your critical projects with simple flexible contracts.

Our principals have done M&A transactions with a total deal value of $46 Billion and led 75 Transformations with $1+ Billion impact.

Mavengigs is a division of Panvisage Inc; initially incorporated in Illinois in 2002; successor was incorporated in Delaware in 2018.

Key Transactions

- Kaleris (Accel-KKR, 2022-23)

- Carnegie Learning (CIP Capital, 2018-19)

- Jacobs ECR / Worley Parsons ($3.2B, 2019)

- Jacobs / CH2M ($3.3B, 2018-2019)

- GE Appliances / Haier ($5.6B, 2015)

- ITW/Signode / Carlyle Group ($3.2B, 2014)

- Ingersoll Rand / Hussmann ($1B, 2011)

- AMLI / Morgan Stanley ($2.1B, 2006)

- Fortune Brands / ACCO Brands ($1B, 2005)

- Real Page/Yield Tech ($10M, 2015)

- ACCO Brands / GBC ($1B, 2005)

EXPERIENCE

- Specializes in M&A strategy, target selection, due diligence, merger integration and divestiture assistance, stranded costs reduction, synergy identification, value creation

- Expertise in business strategy, business transformation, digital transformation, corporate financials, program management, change management, global business shared services, product management, global continuous product delivery.

- With more than 25 years of management consulting and operational experience, he has led or contributed to many transactions across Engineering & Construction, Automotive, Manufacturing, Supply Chain, High Tech, Pharma, Media, Telecommunications and Financial Services.

- Led deal teams of typical M&A players and managed the Integration Management Office (IMO for Integration) and Separation Management Office (SMO for Divestiture).

- Setup and led Transformation Management Office (TMO)

- Led 50+ Transformations, including 30 ERP enterprise deployments (Oracle ERP, other platforms)

- Setup and led Program Management Office (PMO); worked in portfolio, program and project management roles

- Managed changing business models impacted by key technologies, including social, mobile, analytics, embedded devices, cloud, big data, automation and internet of things.

- Managed team of 10 to 500 people; coordinated with internal & external stakeholders and senior C-level executives

- Led his management consulting firm (Panvisage) for 20 years; earlier, Monty worked for Oracle Corporation for 6 years.Technology Platforms:

-

Front Office: Salesforce, Zoho One, Dynamics CRM

-

ERP (Large): Oracle Fusion, Oracle E-Business Suite

- ERP (Mid-Market): NetSuite, Microsoft Dynamics 365

- Best of Breed: Workday, Concur, Hyperion

- Cloud: Amazon Web Services (AWS), Microsoft Azure

- E-Commerce: Shopify

- Google ITIL: Service Now

-

Key roles

-

Roles: Led IMO, SMO, Sign to Close, Day 1/100 Plans, Value Capture, Integrations, Carveouts, Divestitures, Leveraged Buyouts, TSA Services, M&A Playbook, Platform Acquisition, Portfolio Add-Ons

-

Advised C-Suite on a $5.6B M&A Divestiture of a major division for a large manufacturer

-

Due Diligence: Commercial, IT, Operational

-

SMO for (a) $3.3B M&A Divestiture of an engineering & construction company, (b) $3.2B divestiture of a major division for a large manufacturer, (c) $1B divestiture of a division of a manufacturing company

-

IMO for (a) $3.3B M&A Integration for an engineering & construction company, (b) $10M acquisition of a tech company, (c) $1B acquisition of a manufacturing company, (d) Integration of a software company.

Key Roles – Transformation:

-

CTO, Technology Startup

-

Program, Project and Portfolio Management

-

Business Leader: Supply Chain, Manufacturing

-

IT Health Check, IT Leader

-

Go-to-Market (GTM) strategy

-

ERP Implementations & cutovers (30 clients)

-

Change and Communication Management

-

Risk Management and Mitigation

-

Post Implementation Review

-

Established IT platform for new company

-

Replicated IT platform of existing company

-

Data center move; move to cloud

-

Business Intelligence: Financial Reporting

Top M&A Deals

Top TRANSFORMATION Deals

M&A Experience

Kaleris

IMO Director

(2022-23)

Setup and ran the Integration Management Office (IMO) for integration of Navis to Kaleris. Managed delivery of around 20 projects and initiatives that were part of the M&A Integration program. Setup of Transformation Management Office (TMO) for Transformation Projects.

Equinix

Senior Program Manager

(2020)

Supported Equinix’s $335 million acquisition of Packet, Inc. in 2020, aiding the Integration Management Office (IMO) for M&A integration. Collaborated with senior management on Go-To-Market (GTM) Strategy for hybrid multi-cloud infrastructure expansion.

Ensunet

Director, M&A Integration

(2020-21)

Support Ensunet’s management and clients for M&A IT Integration, managing people, process and systems, as well as standards and deliverables for various projects.

JACOBS ENGINEERING & WORLEY PARSONS

Program Director (2019)

Managed the $3.2B divestiture of Jacobs ECR division to Worley Parsons with a program budget of $75M. Oversaw various projects within the program, utilizing platforms such as Oracle E-Business Suite R12, Salesforce, Concur, Hyperion, and BI.

JACOBS ENGINEERING & CH2M

Program Director (2018)

Worked on integration of CH2M Hill Companies into Jacobs (deal value of $3.3B, program budget $30M). Integrated 80% of CH2M business into Jacobs in 6 months; remaining 32 countries integrated in 2019. Platform included Oracle E-Business Suite R12, Salesforce, Concur, Hyperion and BI.

GE APPLIANCES & HAIER

Senior Program Manager

(2016)

Facilitate the sale of GE’s Appliances division to Haier (Deal value of $5.6B, 2016). Advised management on coordinating and managing multiple transformation projects to complete in time to prepare company for sale.

INGERSOLL RAND & HUSSMANN CORPORATION

Project Manager (2014-15)

Facilitated the divestiture of Hussmann Corporation from Ingersoll Rand (Deal value of $1B, 2015). Led the replication of corporate platform, data center and business processes for the new company.

ILLINOIS TOOL WORKS (ITW) / SIGNODE & CARLYLE GROUP

Program Manager (2013-14)

Worked on divestiture of Signode division from Illinois Tool Works (ITW) to form a new company, then participated in managing the sale of new company to the PE firm Carlyle Group ($3.2B, 2014).

REAL PAGE & YIELD TECHNOLOGIES

Program Manager (2013)

Managed integration and new ventures for Real Page, after the sale of Yield Technologies to Real Page Inc (deal value of $10M). Enabled the company to achieve and exceed deal value by unleashing ‘new ventures’ portfolio.

AMLI RESIDENTIAL & MORGAN STANLEY

Program Manager (2010-11)

Managed finance platform upgrade for AMLI Residential, following acquisition of the Chicago REIT by Morgan Stanley to take it private (deal value of $2.1B).

FORTUNE BRANDS / ACCO WORLD

Divestiture Lead (2004-05)

Worked on divestiture of the office products division from ‘Fortune Brands’ to form a new company called ‘Acco Brands’ (deal value $1B); helped setup platform and processes for the new company.

ACCO BRANDS & GBC

Integration Lead (2005)

Worked on the integration of Acco Brands with GBC, to form a combined office products giant (deal value $1B); facilitated the setup of platform and processes; achieved significant savings target.

Transformation Experience

Curaleaf

IT Director (2021-23)

Transforming operations, including standardization and automation across supply chain, manufacturing, supply chain, financials, sales (including retail and wholesale), cultivation, IT, etc. Implementing ERP system for company to support growth through acquisitions.

Panmedical

Chief Technology Officer (2018-23)

Co-Founder of Panmedical, a digital healthcare startup providing Telehealth Services in India. Led development of Telemedicine platform, including patient and doctor workflow and Electronic Health Records (EHR) for B2C & B2B. Transformed the traditional medical office business by rolling out a platform and workflow that connected patients to providers, empowering patients leading to better health outcomes.

Carnegie Learning

Program Director (2020-22)

Managed a team to develop Enterprise Reporting for the company, based on KPI metrics for each line of business, and various business functions. Data was pulled from various source systems, including ERP & CRM systems of businesses acquired in M&A Transactions driven by the Private Equity sponsors.

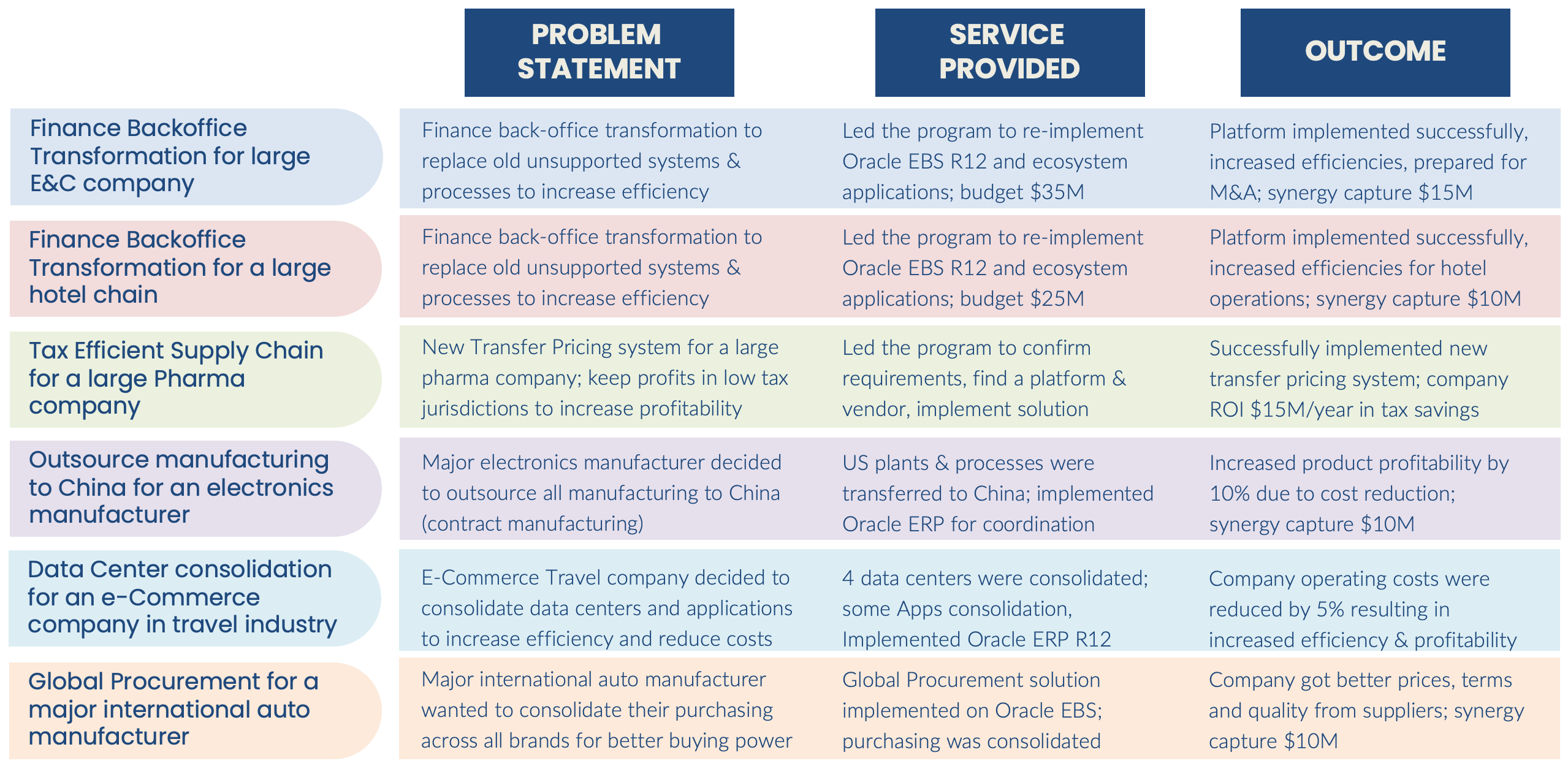

JACOBS ENGINEERING

Program Director (2015-17)

Managed Oracle E-Business Suite R12 based transformation of finance back office (program budget of $35M). Ecosystem included Oracle EBS R12 Finance and HR, Oracle EPM (Hyperion HFM), Business Intelligence (OBIEE, OBIA), Salesforce, Concur and ServiceNow.

HYATT HOTELS

Financial Systems

Consultant (2012-13)

Served as key advisor to the senior leadership team (CFO, CIO) during the ERP based finance transformation of Hyatt’s back-office systems. Coordinated project activities with Oracle and Wipro.

ABBOTT LABORATORIES

Project Manager (2010-12)

Worked with corporate finance to implement a global transfer pricing system to create a ‘tax efficient supply chain’ that would generate target profits in each country of operation.

ZEBRA TECHNOLOGIES

Integration Lead (2009-10)

Served as Integration Lead during the ERP based transformation of Zebra’s back-office systems, and outsourcing of their contract manufacturing to Jabil Circuits (China).

TRAVEL CLICK INC

Project Manager (2008-09)

Worked as a Project Manager for Financial Systems, working with corporate finance. Led ERP based transformation of back office systems and data center consolidation.

ALBERTSONS

Procurement Business Lead

(2006)

Served as a Procurement Business Lead for an Oracle EBS based transformation of back-office systems for Albertsons grocery chain, working with Cap Gemini.

KAPLAN FINANCIALS

Order to Cash Business Lead

(2005)

Served as an Order to Cash Business Lead Consultant for an Oracle EBS based transformation of back-office systems for Kaplan Financials, working with Oracle Consulting.

JM FAMILY ENTERPRISES

Supply Chain Business Lead

(2004)

Served as a Supply Chain Business Lead Consultant for an Oracle EBS based transformation of back-office systems for JM Family Enterprises, a major Toyota dealership chain in southeast USA.

DESCTACO

Project Manager,

Manufacturing

(2004)

Served as a Manufacturing Project Manager for an Oracle EBS based transformation of back-office systems for Destaco, an auto-parts manufacturing company (major supplier of Ford & GM).

UTSTARCOM

Order to Cash Business Lead

(2004)

Served as an Order to Cash Business Lead Consultant for an Oracle EBS based transformation of back-office systems for UTStarCom (divested from 3M).

MEDELA

Electronic Data Interchange

Lead (2003)

Served as an Electronic Data Interchange (EDI) Lead Consultant for an Oracle EBS based transformation of back-office systems for Medela, Inc.

EATON CORPORATION

Manufacturing Business

Lead (2003)

Served as a Manufacturing Business Lead Consultant for an Oracle EBS based transformation of back-office systems for Eaton, an auto-parts manufacturer.

RIGGS BANK

Finance Business Lead (2003)

Served as a Finance Business Lead Consultant for an Oracle EBS based transformation of back-office systems for Riggs Bank (now part of PNC Financials).

SINCLAIR BROADCASTING GROUP

Finance Business Lead (2003)

Served as a Finance Business Lead Consultant for an Oracle EBS based transformation of back-office systems for Sinclair Broadcasting Corporation.

HORMEL FOODS

Procurement Business Lead

(2003)

Served as a Procurement Business Lead Consultant for integration of back-office systems for Hormel Foods, with a company they bought.

FORD MOTOR COMPANY

Global Procurement

Architect (2003)

Served as a Global Procurement Architect for an Oracle EBS based transformation of back-office systems for Ford Motor Company.

MCDONALDS CORPORATION

Project Manager, Logistics

(2001-2002)

Served as a Project Manager for Integrated Logistics for an Oracle EBS based transformation of back-office systems for McDonalds Corporation.

ARAMARK

Finance Technical Lead

(2001)

Served as a Finance Technical Lead Consultant for an Oracle EBS based transformation of back-office systems for Aramark, a major services company.

EMC

Supply Chain Lead (2001)

Served as a Supply Chain Lead Consultant for an Oracle EBS based transformation of back-office systems for EMC, a major computer hardware company.

CARDINAL HEALTH (PYXIS)

Manufacturing Business

Lead (2001)

Served as a Manufacturing Business Lead Consultant for an Oracle EBS based transformation of back-office systems for Pyxis Corp (now part of Cardinal Health).

SANFORD HEALTH (CPC)

Finance Business Lead (2001)

Served as a Finance Business Lead Consultant for an Oracle EBS based transformation of back-office systems for Central Plains Clinic (now Sanford Health).

FIRESTONE

Finance Reporting Lead

(2000)

Served as a Finance Reporting Lead Consultant for an Oracle Technology Stack based transformation of back-office systems for Firestone.

CHICAGO PUBLIC SCHOOLS

Technical Lead (1999-2000)

Served as a Technical Lead Consultant for an Oracle EBS based transformation of back-office systems for Chicago Public Schools, a major public schools system.

ENCYCLOPEDIA BRITANNICA

Technical Lead (1998)

Served as a Technical Lead Consultant for an Oracle Technology Stack based transformation of back-office systems for Encyclopedia Britannica.

AIR LIQUIDE AMERICA

Finance Business Lead (1998)

Served as a Finance Business Lead Consultant for an Oracle EBS based transformation of back-office systems for Air Liquide America, Inc.

TRUSSWAY

Technical Lead (1997)

Served as a Technical Lead Consultant (Microsoft Technology Stack) on multiple projects related to design and construction of building trusses.

HALLIBURTON

Technical Lead (1997)

Served as a Technical Lead Consultant (Microsoft Technology Stack) on multiple projects related to design and construction for Halliburton’s oil contracts.

Client Reviews

★★★★★

★★★★★

★★★★★

MAVENGIGS

16192 Coastal Highway, Lewes, DE 19958

Contact Us

Ph: (310) 694-4750 sales@mavengigs.com

Los Angeles

San Francisco

Las Vegas

Chicago

New Delhi